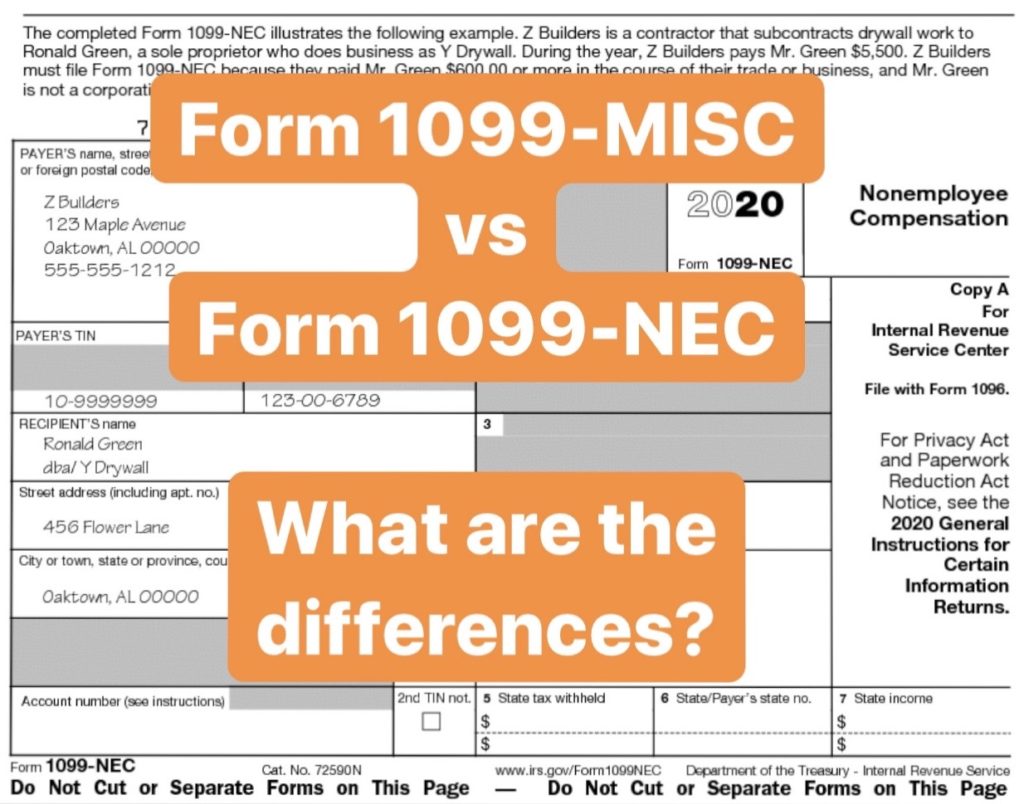

· The Form 1099 MISC is to report the nonemployee compensation in the Box 7 Hence this makes the tax filing due dates in line along with the federal calendar Form 1099 MISC with the Box 7 checked may be due on 31 st January 19 for the tax year 18 and it will still continue to stay on the due on 31 st January moving forward1811 · Previously, business owners would file Form 1099MISC to report nonemployee compensation (in box 7) Now, this compensation is to be listed in Box 1 on the 1099NEC It should be noted that Form 1099NEC was previously used by the IRS until 19 when the IRS added box 7 to Form 1099MISC and discontinued the 1099NEC formAn independent contractor for the services in the course of your business;

Irs Releases Form 1099 Nec Why The Fuss Grennan Fender

How to report 1099-misc box 7 income

How to report 1099-misc box 7 income-Section 530 worker, Specific Instructions for Form 1099NEC, Box 1 Nonemployee Compensation, Examples Selfemployment tax, Box 1 Nonemployee Compensation State and local sales taxes, State or local sales taxes State Information, Boxes 15–17 State Information, Boxes 5–7 State InformationWhen calculating nonemployee compensation for box 7 of the 1099MISC form, should that amount include mileage reimbursement in addition to payments for services render to an independent contractor?

19 Information Reporting Reminders Bkd Llp

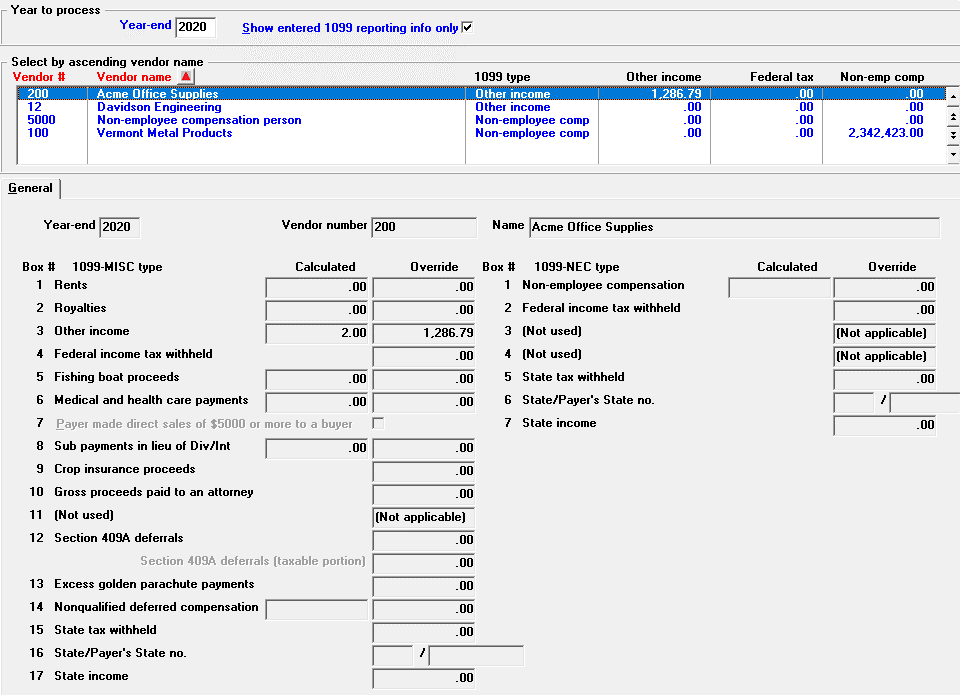

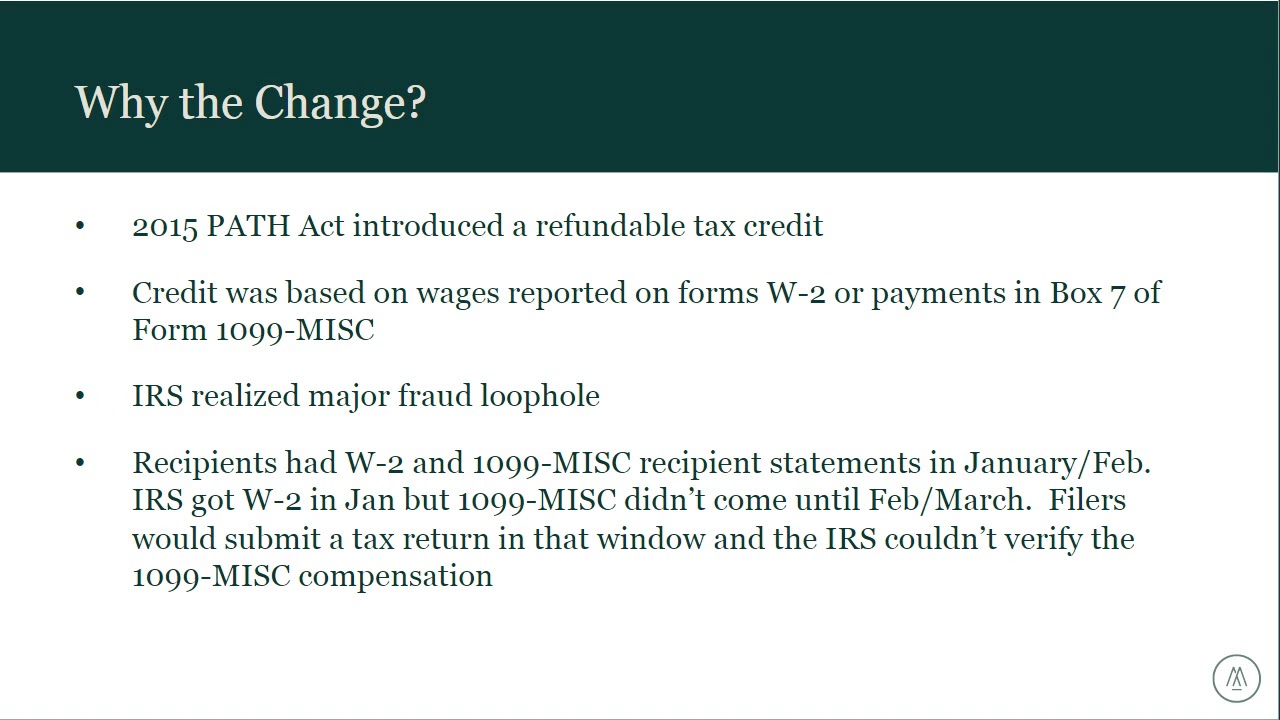

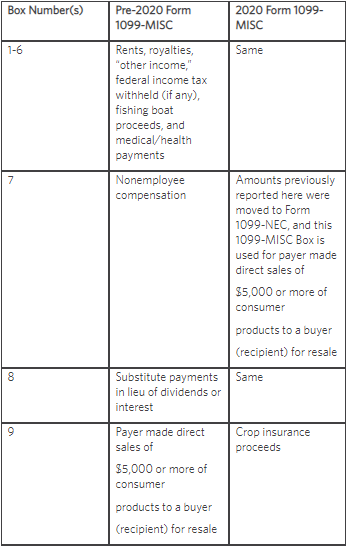

Form 1099NEC Nonemployee Compensation An entry in Box 7 for nonemployee compensation would usually be reported as selfemployment income on Schedule C Profit or Loss from Business The payer of the miscellaneous income did not withhold any income tax or Social Security and Medicare taxes from this miscellaneous incomeForm 1099 NEC is used to report the information to the IRS about Nonemployee compensation offered which was earlier reported on Box 7 of Form 1099MISC3012 · To resolve the various issues, the IRS revived Form 1099NEC, effectively separating Box 7 (nonemployee compensation) from the 1099MISC, as well as staggering the filing due dates The version of Account Ability Tax Form Preparation Software includes full support for Form 1099NEC User Interface as well as Form 1099MISC User Interface

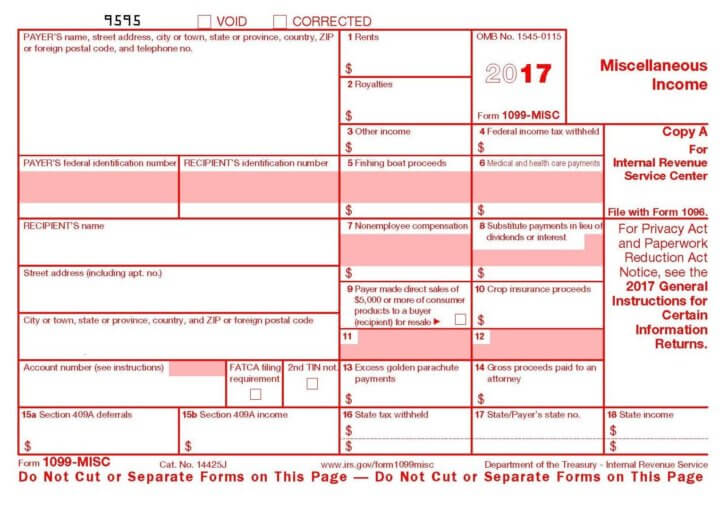

1510 · Prior to tax year , nonemployee compensation was reported in Box 7 on Form 1099MISC However, with the passing of the Protecting Americans from Tax Hikes (PATH) Act in 15, the due date for reporting amounts in Box 7 was accelerated to Jan 31, while the deadline for reporting most other information on Form 1099MISC remained at Feb 28, if filing on paper, and0812 · With Box 7 eliminated from Form 1099MISC, the new Form 1099NEC is where businesses have to report nonemployee compensations As the New Year is approaching faster than ever, businesses are preparing for a lesschallenging 21 by gathering all the information needed to efile Form 1099NEC for the tax year 21Beginning in January 19, the IRS will enact new rules regarding submission of 1099MISC with nonemployee compensation (Box 7) In 17, there was a 30day automatic deadline extension for 1099MISC with Box 7, which meant that forms were not due until early March

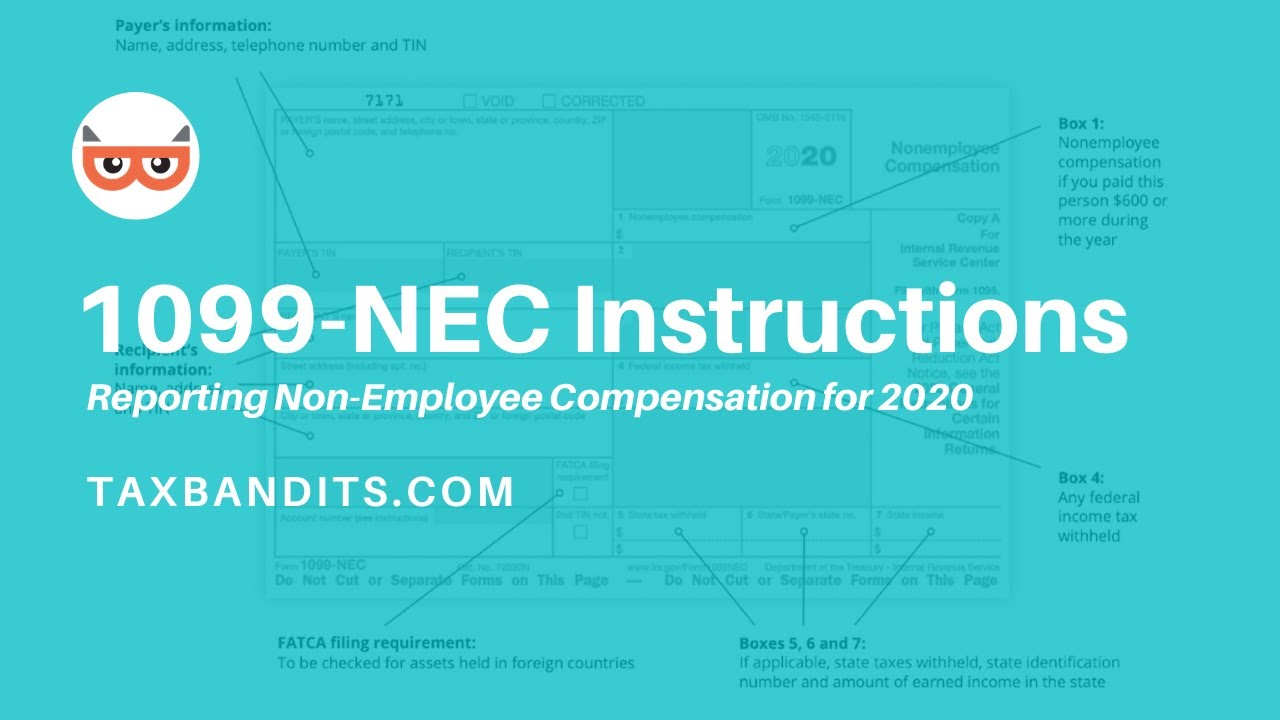

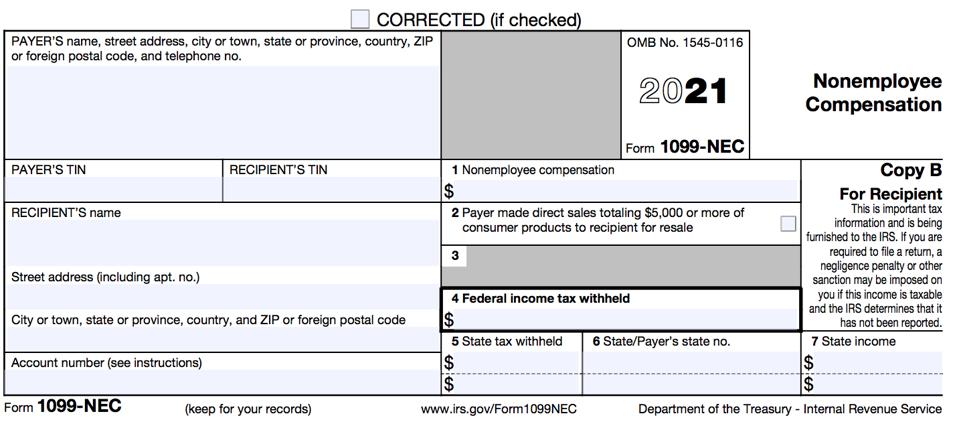

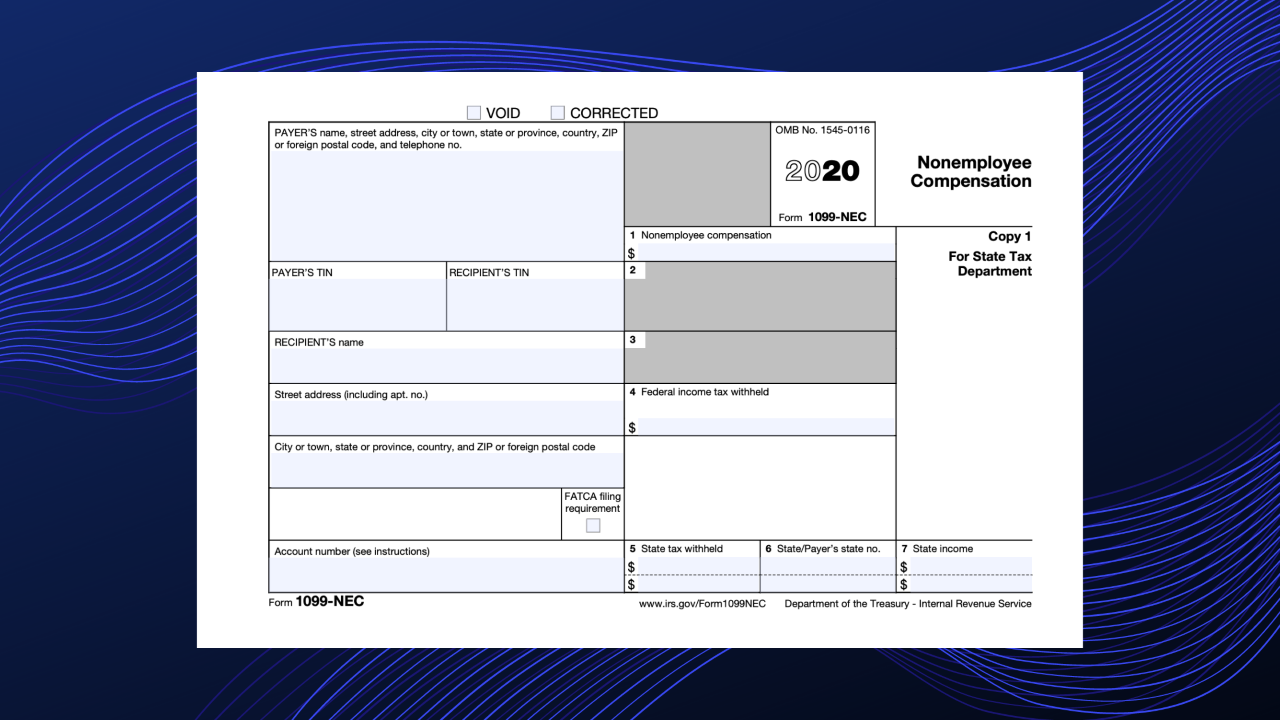

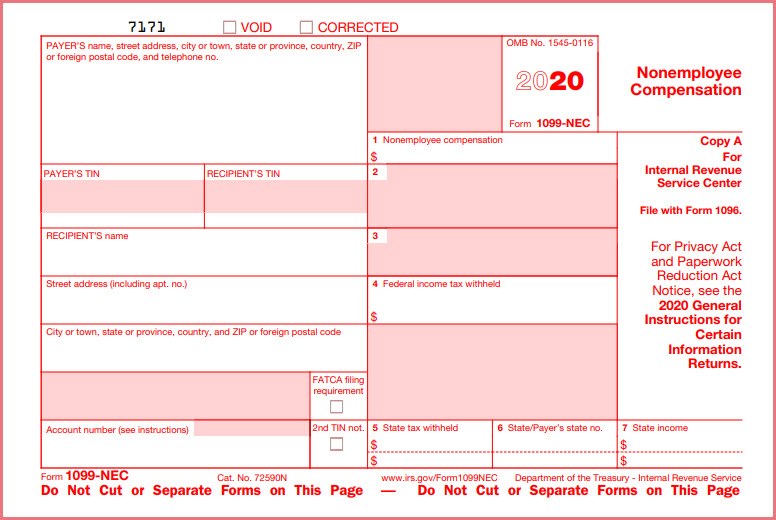

I have a client with two 1099misc box 7 (nonemployee compensation) for 19 and they were in fact entered through Input Return Income SS Benefits, Alimony, Misc Income But when we pull up the tax return these entries are not shown for some reason So2309 · You'll also find that the boxes have been rearranged on the 1099MISC; · Beginning with the tax year (to be filed by February 1, 21) the new 1099NEC form will be used for reporting nonemployee compensation (NEC) payments Previously NEC was reported in Box 7 of the 1099MISC form These payments will now be reported in Box 1 of the 1099NEC form There are several parts of the new 1099NEC form to take note of

1099 Nec Or 1099 Misc What Has Changed And Why It Matters Pro News Report

How To Add 1099 Nec To Your Sage 100 Tax Forms

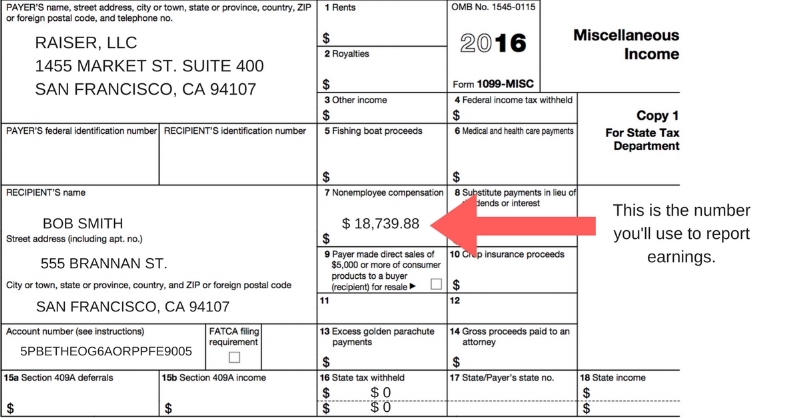

If you filed 1099MISC with only Box 7 in the past you should most likely choose Box 1 Nonemployee Compensation on the 1099NEC This is the most common situation and the only box most businesses will need to select for payment types If you have other payment types, you'll need to file both forms · Condition for entering 1099 MISC (box 7) as nonemployee compensation The general rules for classifying the nonemployee compensation relates to any payment made to the recipients for $600 or more during the tax year;When you receive a 1099MISC with income in Box 7 that is for nonemployee compensation, the IRS requires that this income be reported on a Schedule C If you are filing a 1099MISC with income in Box 7, you will be prompted to Add the income to an existing Schedule C or create a new Schedule C after completing the 1099MISC entry

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

About The 1099 Misc Income Box 7 Tax Rule

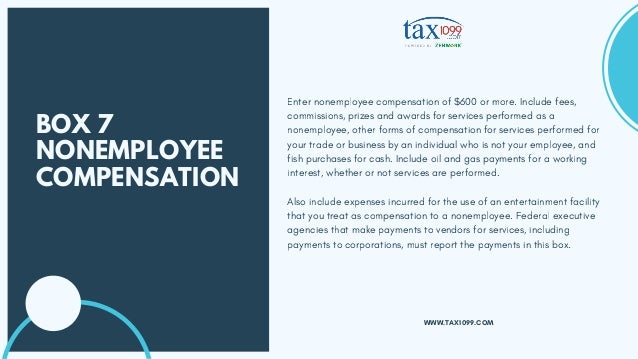

The renewed Form 1099NEC is only used for nonemployee compensation, meaning it only replaces Box 7 on the Miscellaneous income form Everything else is still filled under the same Form 1099MISC That means that rents, attorney fees, crop insurance proceeds, proceeds from a fishing boat, the state earned income, etc, and many more, are still filled under this formFORM 1099MISC Box 7 – Nonemployee Compensation »Enter nonemployee compensation of $600 or more –include fees, commissions, ©18 Region One Education Service CenterThe following is from the instruction for Form 1099MISC "A fee paid to a nonemployee, including an independent contractor, or travel reimbursement for which the nonemployee

1099 Nec And 1099 Misc What S New For Form1099online By Form1099 Issuu

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Understanding The 1099 Misc Tax Form

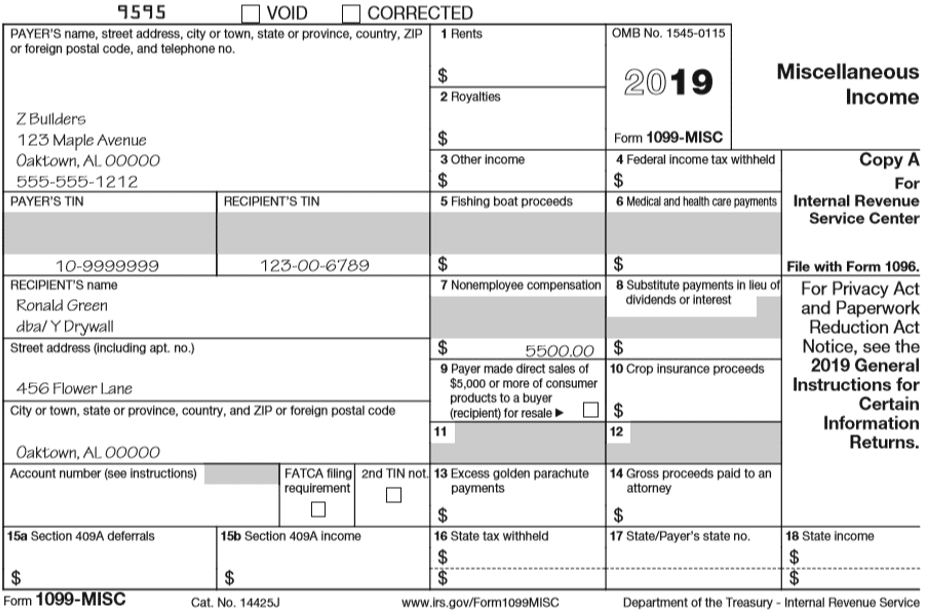

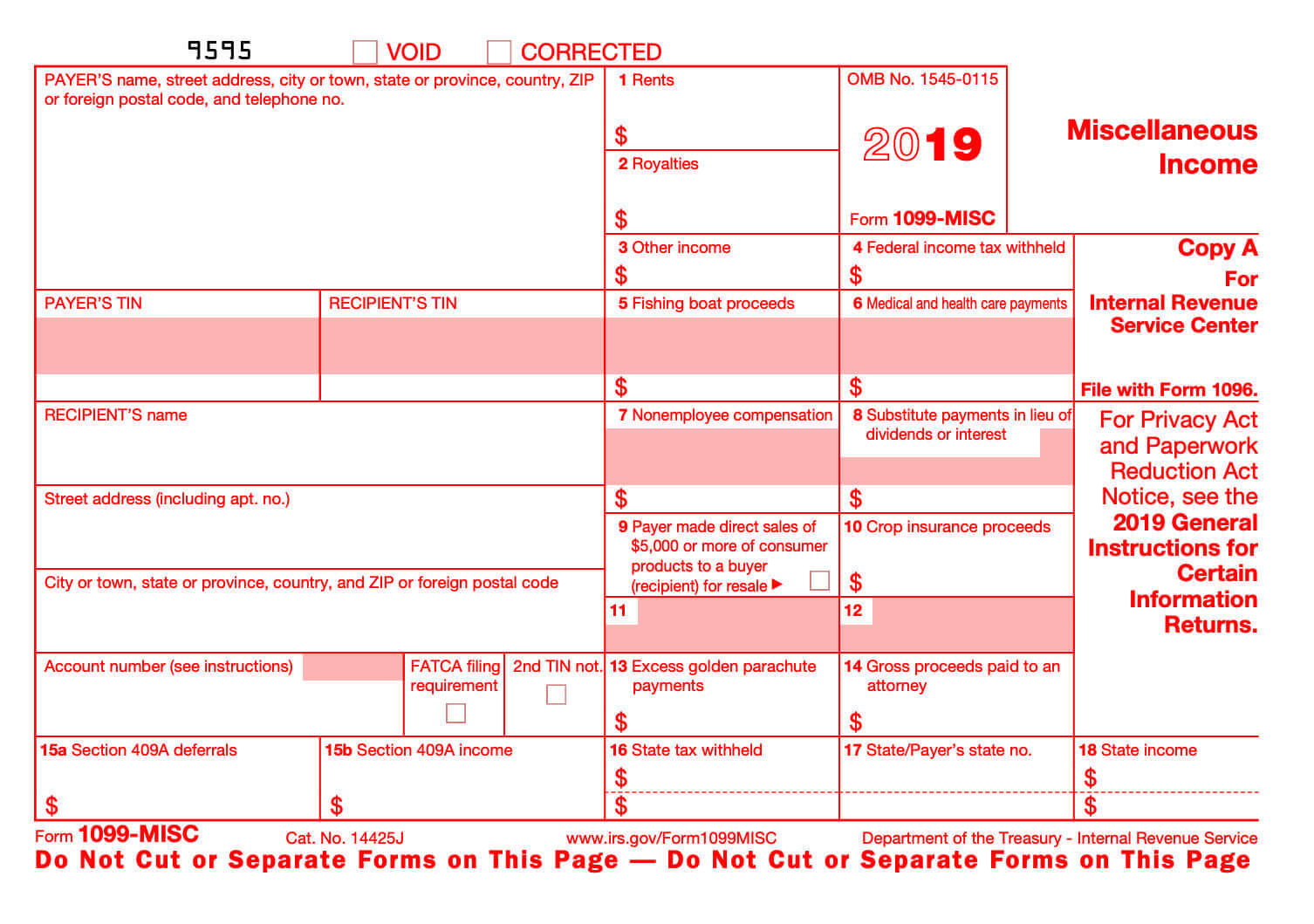

Data previously reported on Box 7 (Nonemployee compensation) of the 1099MISC, the new 1099NEC will capture any payments to nonemployee service providers, such as independent contractors, freelancers, vendors, consultants and other selfemployed individuals (commonly referred to as 1099 workers) for tax yearYes, the IRS had 1099NEC years and years ago, and they Reactivated it This removes Box 7 "Nonemployee Compensation" from the 1099Misc That means the 1099Misc for tax year has a new layout, and box 7 is now a Different purpose It's the same concept with the changes to the form 1040 line numbers They changed over the years · If you're selfemployed you will need to know how the 1099MISC tax form works, including Box 7 Box 7 of IRS Form 1099MISC is where nonemployee compensation is reported This means, if there is an amount in box 7, the company that sent you the 1099 doesn't consider you an employee

Form 1099 Nec Returns Form 1099 Misc Minneapolis St Paul Mn

19 Information Reporting Reminders Bkd Llp

· Unfortunately, when the payor puts the amount in Box 7, it is considered selfemployment income (they should use Box 3) There is a workaround, though Type '1099misc' in the search window, and 'Jump to 1099Misc' At the 1099Misc Summary, EDIT the entry you want to change For type of income, choose 'none of the above'This form will replace box 7 on Form 1099MISC for the calendar year that will be reported in 21 What changed Get in your DeLorean, · Box 7, Nonemployee compensation2611 · Before , tax filers use box 7 in 1099 MISC for including nonemployee compensation In reporting of nonemployee compensation is possible with form 1099NEC Reporting with Form 1099 NEC You all know that form 1099 NEC is for reporting nonemployee compensation

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

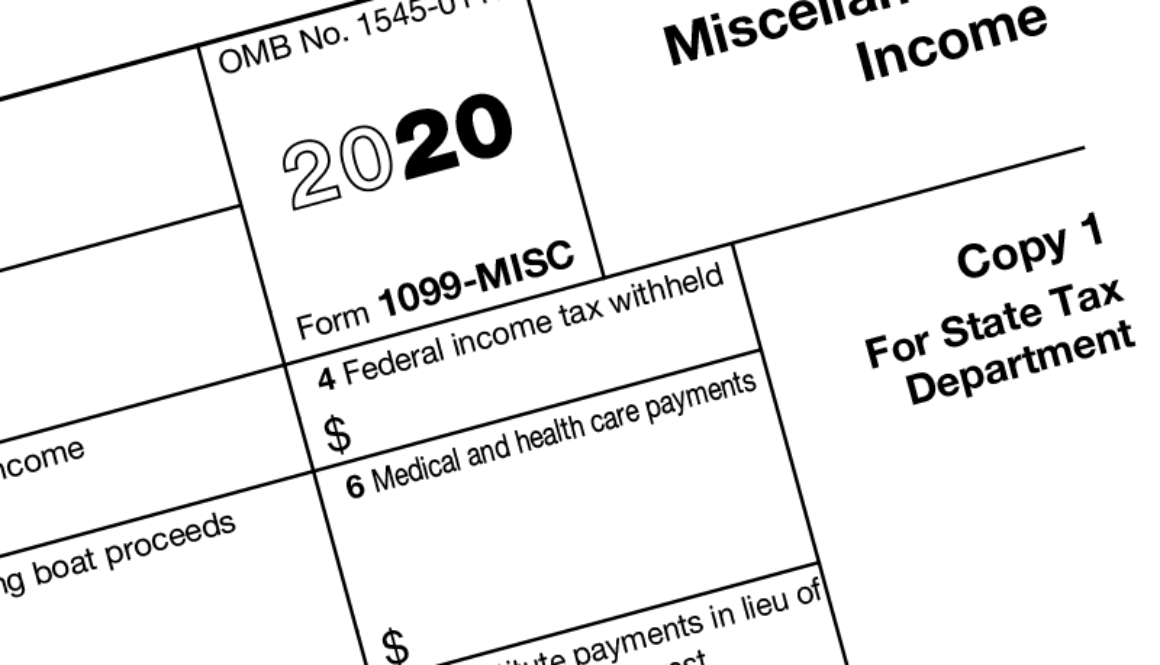

If the payment is in Box 2, Royalties, Box 5, Fishing boat proceeds, or Box 6, Medical and health care payments (or Box 7, Nonemployee compensation prior to ) after exiting the 1099MISC entry screen you will be queried if you would like to link it to a Schedule C Answer Yes or No as appropriate, bearing in mind that not linking the 1099MISC to a Schedule C will result in theHttp//wwwtaxactcom If you have a Box 7 entry on Form 1099MISC, the IRS requires you to report it as selfemployment income on Schedule C or F It's eas1502 · Form 1099NEC essentially replaces box 7 (labeled nonemployee compensation) on form 1099MISC Subsequently, box 7 on form 1099MISC for tax year has been removed Actually, this new form was an old form that has not been in use since 19 Because there were separate filling dates for box 7 on the 1099MISC and the other types of

Your Ultimate Guide To 1099s

1099 Nec Non Employee Compensation Blank Face Backer 11 Z Fold 1099necb

1812 · Essentially, the difference between forms 1099NEC and 1099MISC is that nonemployee compensation used to be reported in Box 7 of Form 1099MISC Now, Box 7 has been separated out into its own form NEC payments are now reported in Box 1 of this new form, 1099NEC Form 1099MISC still exists, but it has been modified and redesigned · If payment for services you provided is listed on Form 1099NEC, Nonemployee Compensation, the payer is treating you as a selfemployed worker, also referred to as an independent contractor You don't necessarily have to have a business for payments for your services to be reported on Form 1099NEC You may simply perform services as a nonemployee2511 · The IRS has introduced Form 1099NEC again, after 19, in order to avoid the confusion in deadlines for filing Form 1099MISC Form 1099NEC must be filed to report nonemployee compensation paid in a year, which has been reported in Box 7 of 1099MISC Read on to learn more about Form 1099NEC Following are the topics covered in this article

Hhm

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

· NonEmployee Compensation is filed with IRS through the Form 1099MISC in Box 7 and it is subject to selfemployment tax Any payment not subject to selfemployment tax and not reported elsewhere on Form 1099MISC must be reported in Box 3 – Other income Condition for entering 1099 MISC (box 7) as nonemployee compensation0212 · One of my small business clients received a form 1099misc from one of her customers for whom she'd performed a business service The customer unknowingly reported the income using box 3 "Other Income" when she should have reported it in box 7 "Nonemployee Compensation" · Nonemployee compensation appears on line 7 of Form 1099MISC Excerpted from the 1099MISC Instructions, the following items are some common examples of payments reported on box 7 (see the instructions for full details and other references) Professional service fees Directors' fees Payment for services Nonemployee fees or commissions

1099 Nec 1099 Express

1099 Nec Available Page 4

Nonemployee Compensation on 1099 NEC Form For more details regarding IRS Form 1099 NEC, contact our customer care number on 1 (316) To File your IRS 1099 Form NEC, visit our website at wwwefile1099misccomForm 1099NEC replaces Form 1099MISC with box 7 data as the new form for reporting nonemployee compensation This change is for the tax year, which are filed in 21 Why the Change Occurred Back in 15, the PATH (Protecting Americans from Tax Hikes) Act changed the due date for 1099MISC forms with data in box 7 from March 31 to · 1099Misc Scenario 5 Client received 1099Misc and the income is incorrectly classified Mary won a prize from a local community sponsored activity She received a Form 1099Misc with the prize amount reflected in Box 7 as "Nonemployee Compensation"

1099 Misc Reporting Questions Answers By Smith Schafer Cpas

Irs Form 1099 Reporting What Payments To Report Ppt Download

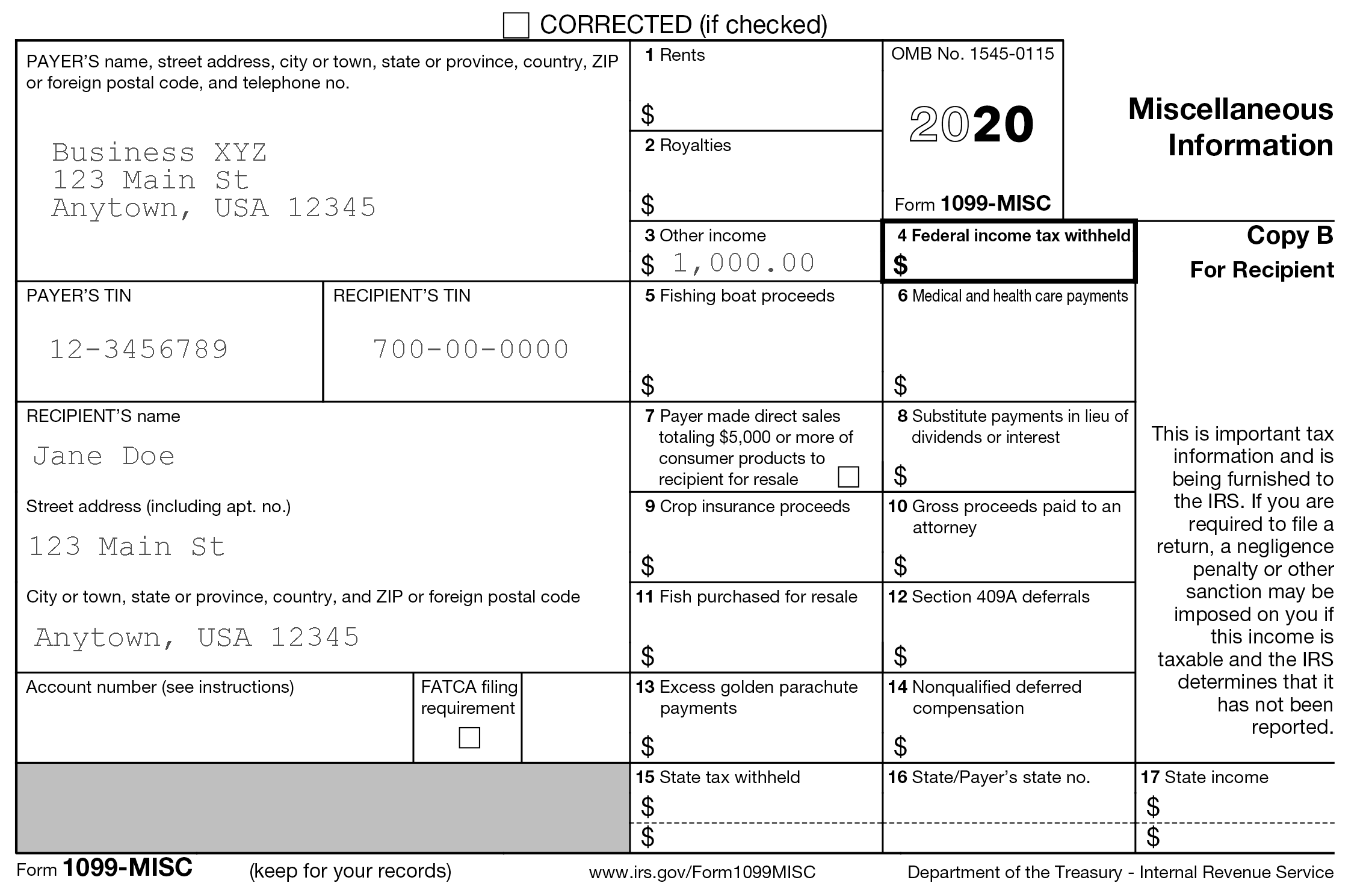

0401 · IRS Form 1099MISC Box7 (NonEmployee Compensation – NEC) filing is generally performed by an organization for any payments made to the selfemployed professionals and independent contractors who earn their income outside the usual employeremployee association2511 · As mentioned, there are some changes in Form 1099MISC for the tax year due to the reporting of nonemployee compensation in Form 1099NEC Here are the changes in Form 1099MISC for Box 7 Box 7 is now changed as a checkbox for Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale0505 · Box 7 Moved From 1099MISC Form Previously, businesses reported all nonemployee compensation on the 1099MISC form Nonemployee compensation was reported on Box 7 of the form, which is now used to report if a payer made direct sales of $5,000 or more

1099 Misc Public Documents 1099 Pro Wiki

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

· The issuer is using an old 1099MISC form (not for ) and is reporting your nonemployment compensation in box 7 Or, The issuer sent you the 1099MISC form with only box 7 checked and sent you a 1099NEC separately that reports the actual income amount Take a look at the year on your 1099MISC form · What forms or boxes do I choose?*Effective Tax Year the 1099MISC is no longer used to report nonemployee compensation Box 7 For tax year , i s a check box, If checked, $5000 or more of direct sales of consumer products was paid to you a buyer (recipient) for resale A dollar amount does not have to be shown

1099 Nec Efile 1099 1099 Nec Form By Form1099 Issuu

Amazon Com 1099 Nec And 1099 Misc 4 Part Tax Forms Combo Kit For All Non Employee Compensation Filing Self Seal Envelopes Included Quickbooks And Other Software Compatible Office Products

Box 7, where nonemployee compensation was once reported, now hosts the check box for direct sales of $5,000 or more · 1 Nonemployee compensation, presently box 7 of the 1099MISC Form Note This box also used to report cash got from the sale of fish by a payee in the trade of catching fish 2 Federal backup withholding used report in box 4 and three boxes for state tax details used to report in 5 to 7 boxes Why E File 1099 NEC Form?Get ready for the new 1099NEC and changes to 1099MISC filing New Form 1099NEC The IRS has made big changes to the 1099MISC form by reviving the 1099NEC form Beginning with the tax year (to be filed by February 1, 21) the new 1099NEC form will be used for reporting nonemployee compensation (NEC) payments Previously NEC was reported in Box 7 of the 1099MISC

Know Which Irs Form To Use If You Paid Independent Contractors Small Business Trends

trix 1099 Tech Tips

An individual who is not a direct employee; · The form is a redesign of a 19 form by the same name In more recent years, prior to , nonemployee compensation was reported in box 7 on the Form 1099MISC Form 1099NEC was resurrected

What If I Got A 1099 Misc With Only Box 7 Informat

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Accounts Payable Software For Small Business Accurate Tracking

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Amazon Com 1099 Nec And 1099 Misc 4 Part Tax Forms Combo Kit For All Non Employee Compensation Filing Self Seal Envelopes Included Quickbooks And Other Software Compatible Office Products

1099 Misc Form Copy C 2 Recipient State Zbp Forms

What Is Form 1099 Nec

Irs 1099 Changes Impact On Microsoft Dynamics Gp Rand Group

Form 1099 Nec Released For The Filing Year Berntson Porter Company Pllc

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements Hw Co Cpas Advisors

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Irs Releases Form 1099 Nec Why The Fuss Grennan Fender

Form 1099 Filing Update For Nonemployee Compensation Youtube

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

1099 Misc 1099 Express

Form 1099 Nec Non Employee Compensation Replaces 1099 Misc For Reporting Payments To Non Employees S J Gorowitz Accounting Tax Services P C

Major Changes To File Form 1099 Misc Box 7 In

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec Blue Summit Supplies

Change To 1099 Form For Reporting Non Employee Compensation Ds B

1099 Misc Form Fillable Printable Download Free Instructions

Acumatica 1099 Nec Reporting Changes Crestwood Associates

Form 1099 Nec Vs 1099 Misc For Tax Year Blog Taxbandits

Irs Introduces New 1099 Nec Form To Report Nonemployee Compensation

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Form 1099 Nec For Nonemployee Compensation H R Block

New 1099 Nec Form For Independent Contractors The Dancing Accountant

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Need To File 1099 Misc For 18 What You Need To Know S J Gorowitz Accounting Tax Services P C

Irs Form 1099 Misc Alizio Law Pllc

1099 Misc Form Copy A Federal Discount Tax Forms

1099 Filing Deadlines For 1099 Misc And 1099 K

You Can T Trust Your 1099s Endovascular Today

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec Blue Summit Supplies

Form 1099 Misc It S Your Yale

1099 Misc And Nec Changes Immediate Action Steps For Gp Users

Acumatica 1099 Nec Reporting Changes Crestwood Associates

Umm Maybe I Forget To Start Using The 1099 Nec Form And Boxes Umm Help Sage X3 Support Sage X3 Sage City Community

Irs Revives Form 1099 Nec Information Return For Nonemployee Compensation Accounting Today

Self Employed Vita Resources For Volunteers

1099 Misc Form Copy B Recipient Zbp Forms

Transitioning From The 1099 Misc To The 1099 Nec Form How Does This Impact You

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Taxseer Irs Form 1099 Misc Box 7 Non Employee Compensation Basics Irs Forms Irs Basic

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Clearing The Confusion 1099 Misc Or 1099 Nec

I Received A Form 1099 Misc What Should I Do Godaddy Blog

Nonemployee Compensation Reportable On Revived Form 1099 Nec For Payments Lexology

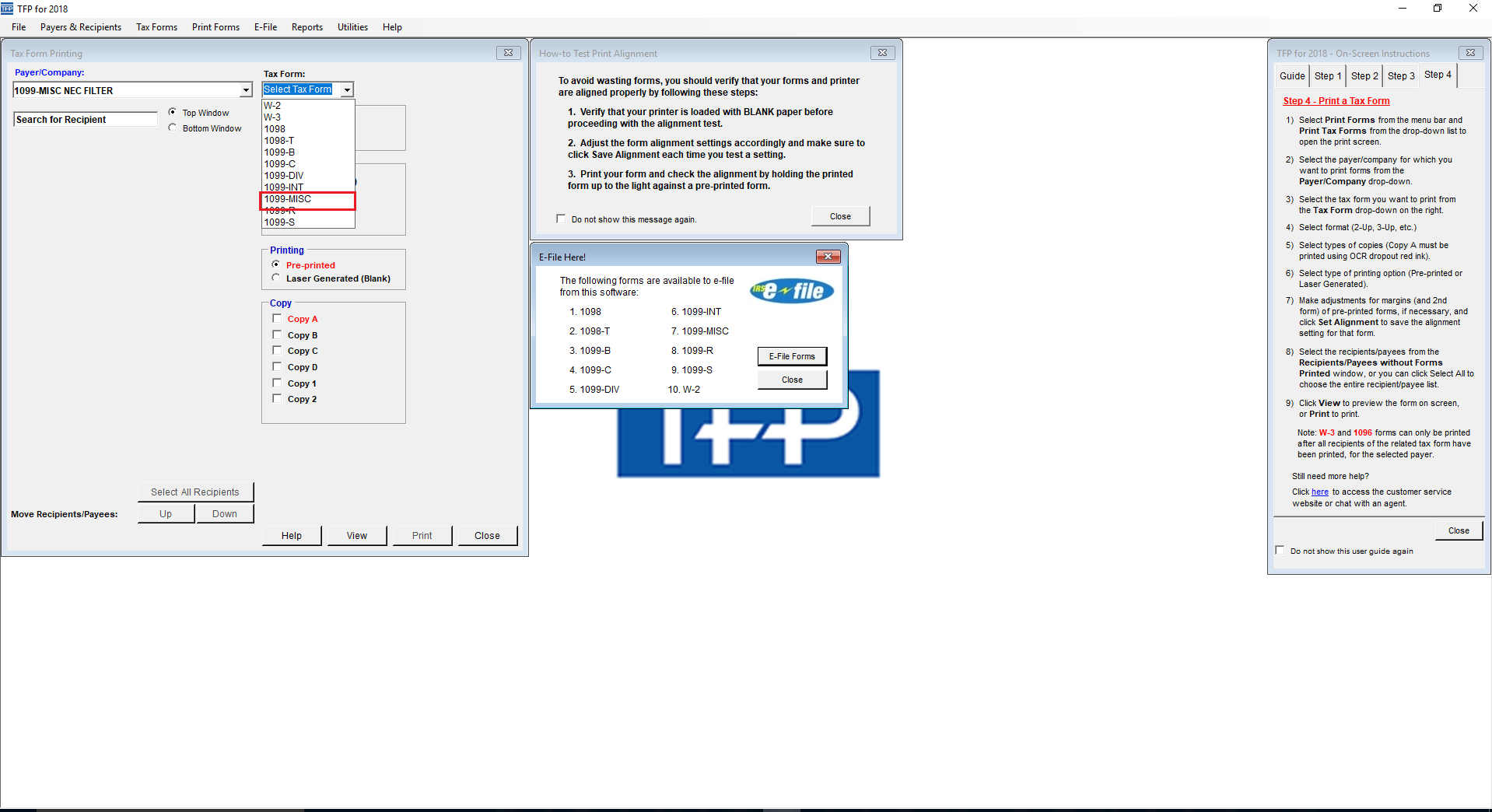

Filtering 1099 Misc By Box 7 Nec Nonemployee Compensation 18 19 Software Tax Software Web Support Services

Irs 1099 Misc Vs 1099 Nec Inform Decisions

Re How Do I Link To Schedule C On My 1099 Misc Fo

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

When Are 1099 Forms Due And More Important Dates To Remember

Form 1099 Nec What Does It Mean For Your Business

Direct Fee Payment To Representatives And Form 1099

19 Form 1099 Misc How To Read Form 1099 Misc Boxes And Descriptio

Ready For The 1099 Nec

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)

Form 1099 Nec What Is It

How To Use The New 1099 Nec Form For Dynamic Tech Services

What Is A 1099 Misc Personal Finance For Phds

Amazon Com Tops 1099 Nec Forms 4 Part Laser Inkjet 1099 Forms With Self Seal Envelopes For 25 Recipients Includes 3 1096 Forms Tx Nec Office Products

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Amazon Com 1099 Nec And 1099 Misc 4 Part Tax Forms Combo Kit For All Non Employee Compensation Filing Self Seal Envelopes Included Quickbooks And Other Software Compatible Office Products

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

How To Read Your 1099 Misc

The New Irs Form 1099 Nec Summarized

Filtering 1099 Misc By Box 7 Nec Nonemployee Compensation 18 19 Software Tax Software Web Support Services

Form 1099 Nec Or Form 1099 Misc Delano Sherley Associates Inc

Filing Form 1099 Nec Beginning In Tax Year Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Irs Makes Substantial Changes To 1099 Misc Form Williams Keepers Llc

Irs Takes Non Employee Compensation Out Of 1099 Misc New Form 1099 Nec Cpa Practice Advisor

Form 1099 Nec Replacing 1099 Misc Box 7 Ondemand Course Lorman Education Services

0 件のコメント:

コメントを投稿