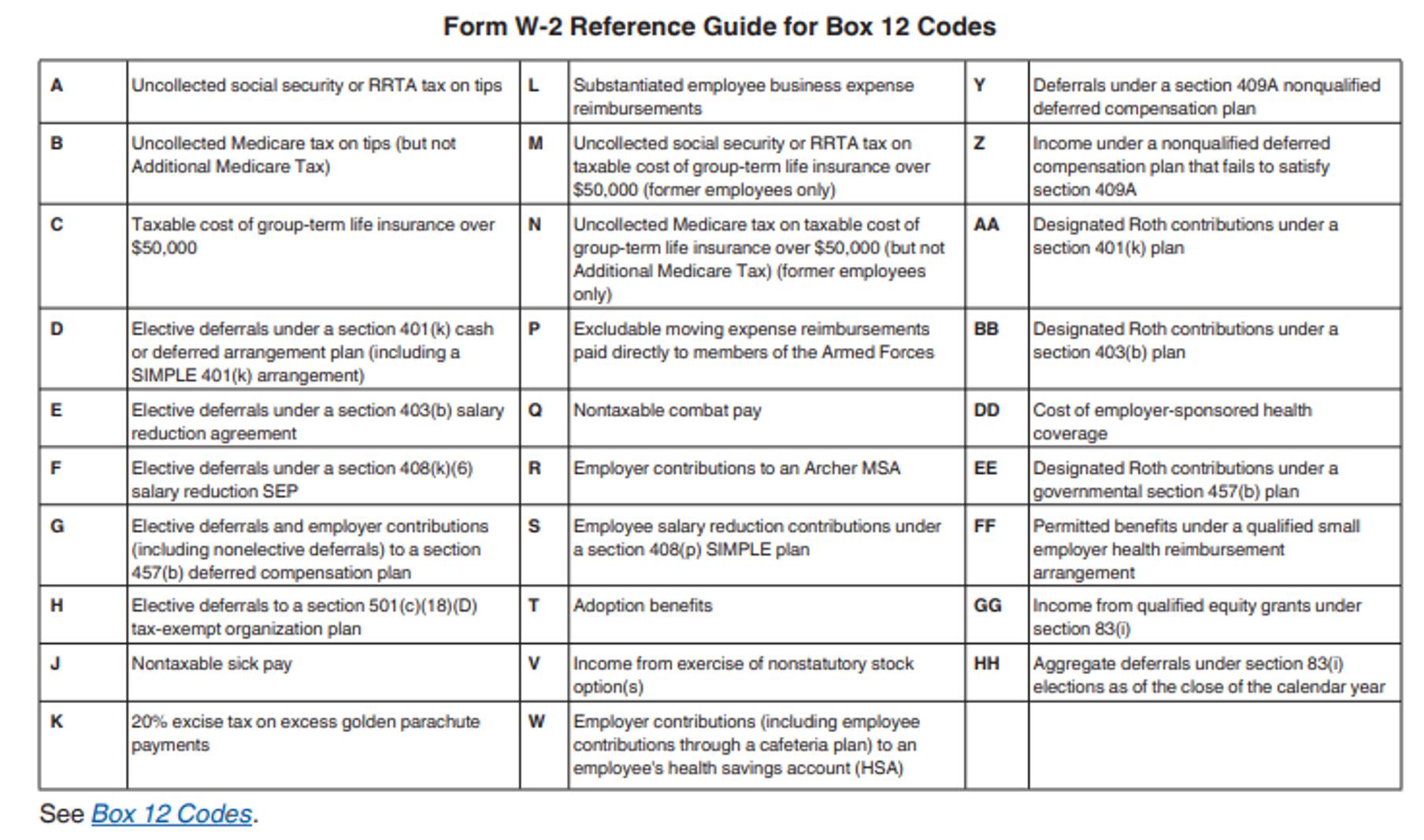

コンプリート! example 1095c filled out Example 1095c filled out リンクを取得 ;Sample 1095 C Forms Aca Track Support How to use form 1095c How to use form 1095cFullTime Employee Hired Midyear;Form 1095C is used by applicable large employers (as defined in section 4980H(c)(2)) to verify employersponsored health coverage and to Form1095C Colorado State University Colorado State University provides employees with the 1095C tax formStick to the fast guide to do Form 1095C, steer clear of blunders along with furnish it in a timely manner How to complete any Form 1095C online On the site with all the document, click on Begin immediately along with complete for the editor Use your indications to submit established track record areas Add your own info and speak to data Make sure that you enter correct

Hr Emory Edu Eu Includes Documents Sections Home W2 Instructions Pdf

Sample 1095 c forms completed

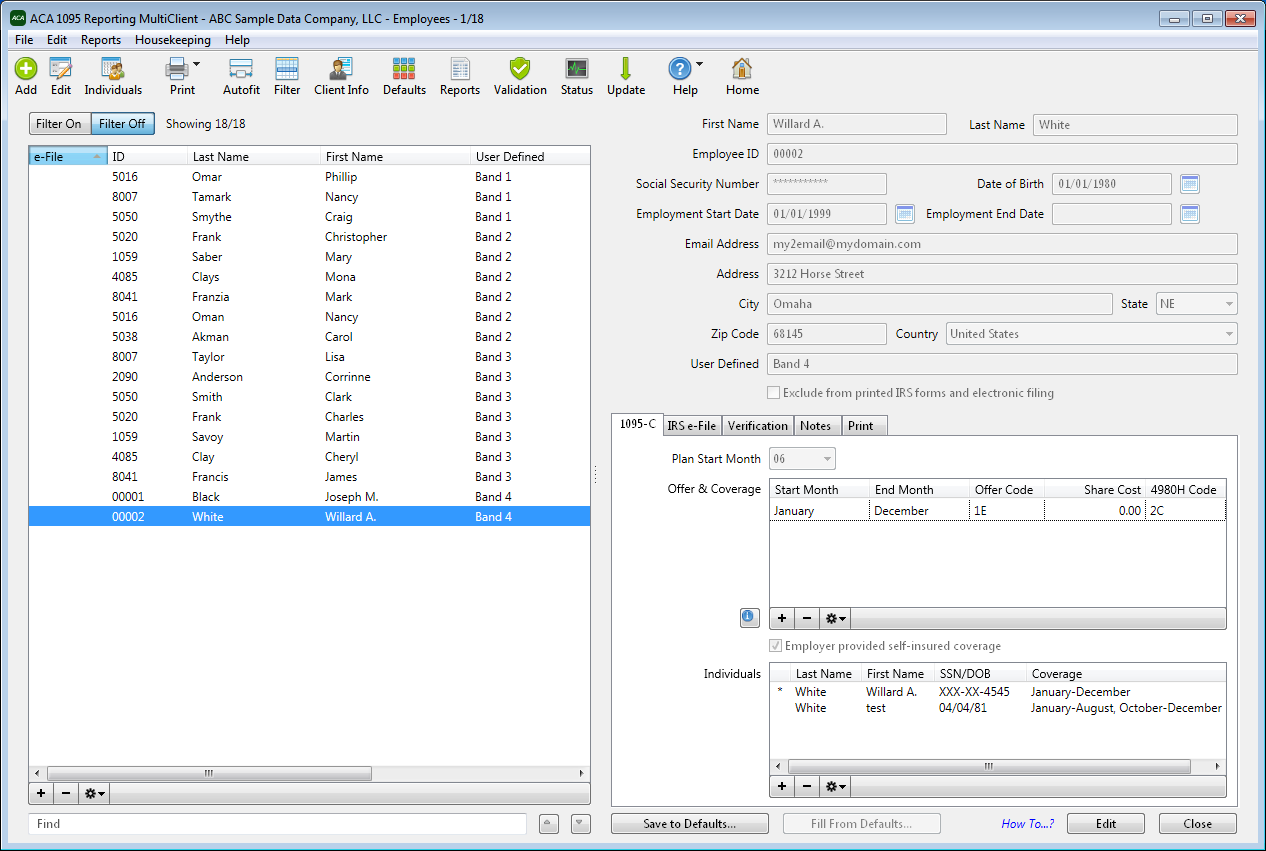

Sample 1095 c forms completed-Sample Company 15 1095 Mate Tools Help Company Import Data SSN Employee and 1095 Summary 1094 Electronic Filing Enable Optional F ea tur es Employee Last Name Smith Address 555 Orange Lane 44 Lake Street 55 Maple Street 123 West Pine Street 23 Main Street I East End Maplewood Pine Town Homet Eastwood State 47 Employee First Name Jane John Mary 3 Form 1095CWith so many changes with the new Affordable Care Act or ACA, we are just beginning to understand the bigger picture of it all Check out this video for mor

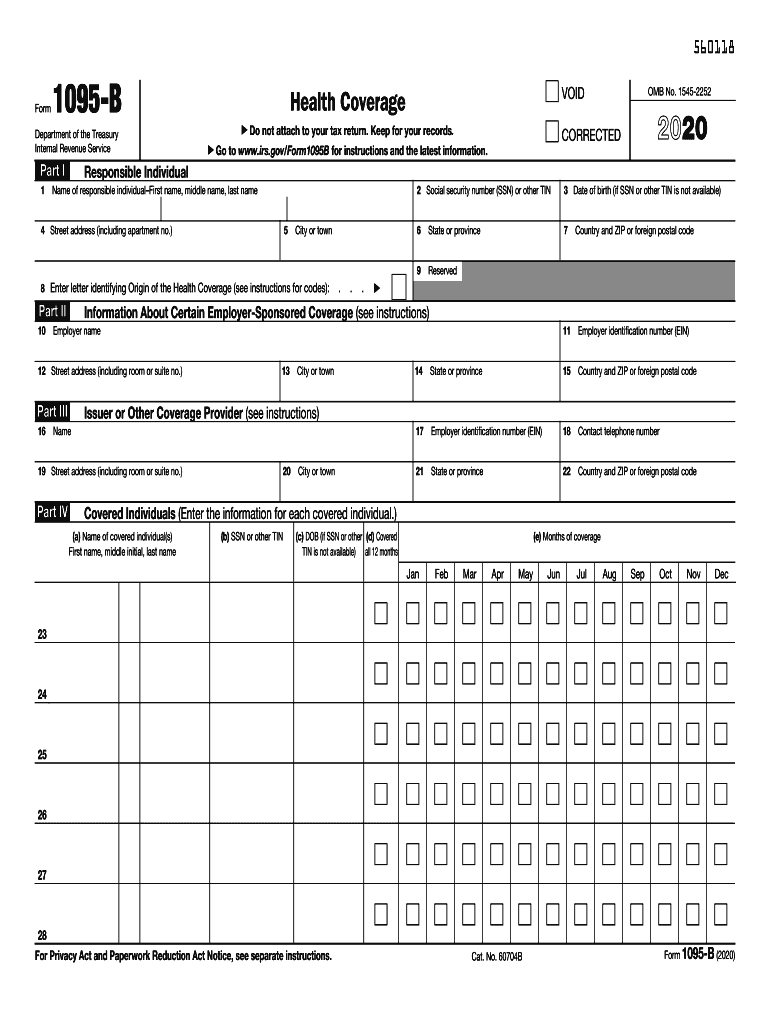

Guide To Prepare Irs Aca Form 1095 B Form 1095 B Step By Step Instructions

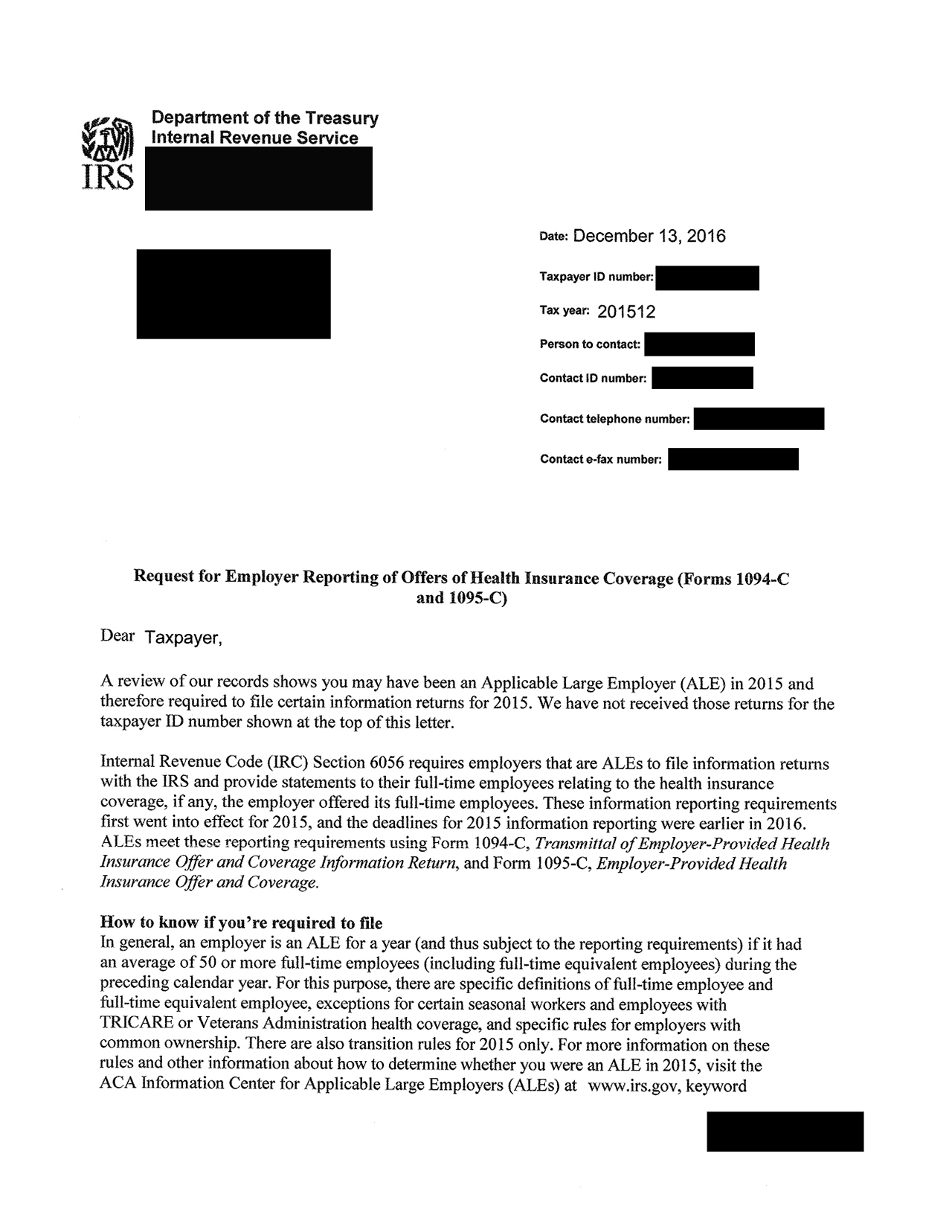

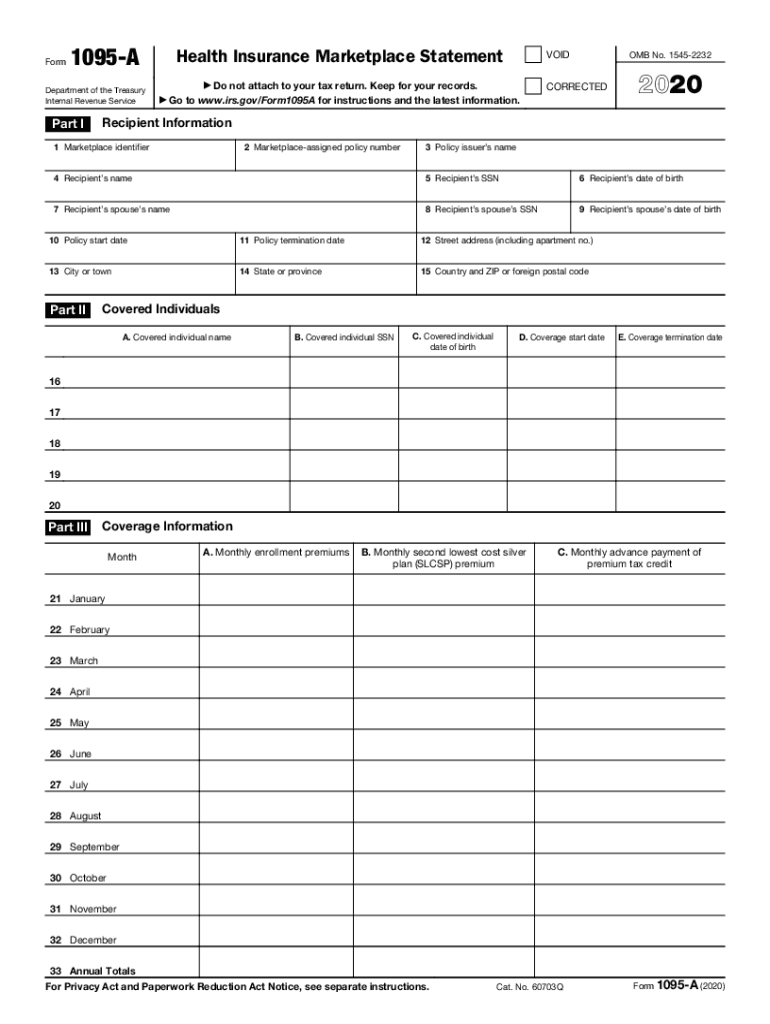

Form 1094C and Form 1095C (and related instructions) will be used by ALEs (eg employer with 50 or more fulltime employees including fulltime equivalents) that are reporting under Section 6056, and for combined reporting by ALEs that sponsor selfinsured plans required to report under both Sections 6055 and 6056The Form 1095C print and the 1094C or 1095C XML files are handled through the JD Edwards Electronic Document Delivery (EDD) system The system uses the data item aliases during the spool file batch export step to create XML source files, which are then used to map the information to The Form 1095C RTF file (for the printed Form 1095C's)ダウンロード済み√ 1095 c form example 2875How to request form 1095c Sample 1095C Documents The following examples assume your company's health benefits meet minimum value, are not part of a qualifying offer outlined in 1A above, and are offered unconditionally to both spouses and dependent children Each employee situation is different, and your 1095C form may

The penalties are levied based on the information provided by employers on their 1094C and 1095C forms Section 4980H (a) A penalty will be levied on an employer if Minimum Essential Coverage (MEC) is not offered to at least 95% of their fulltime employees and if any employee receives a Premium Tax Credit (PTC) through the marketplaceForm 1095C is intended to include all the necessary information to allow the recipient and/or the tax preparer to properly complete and file the recipient's tax return All applicable large group employers (ALE's) are required to prepare, distribute and file IRS Form 1095C This form includes information that will identify which months an individual and any enrolled dependents were 1095B – This form is used by insurance companies to report information about individuals who are covered by minimum essential coverage and are not liable for the individualshared responsibility payment ;

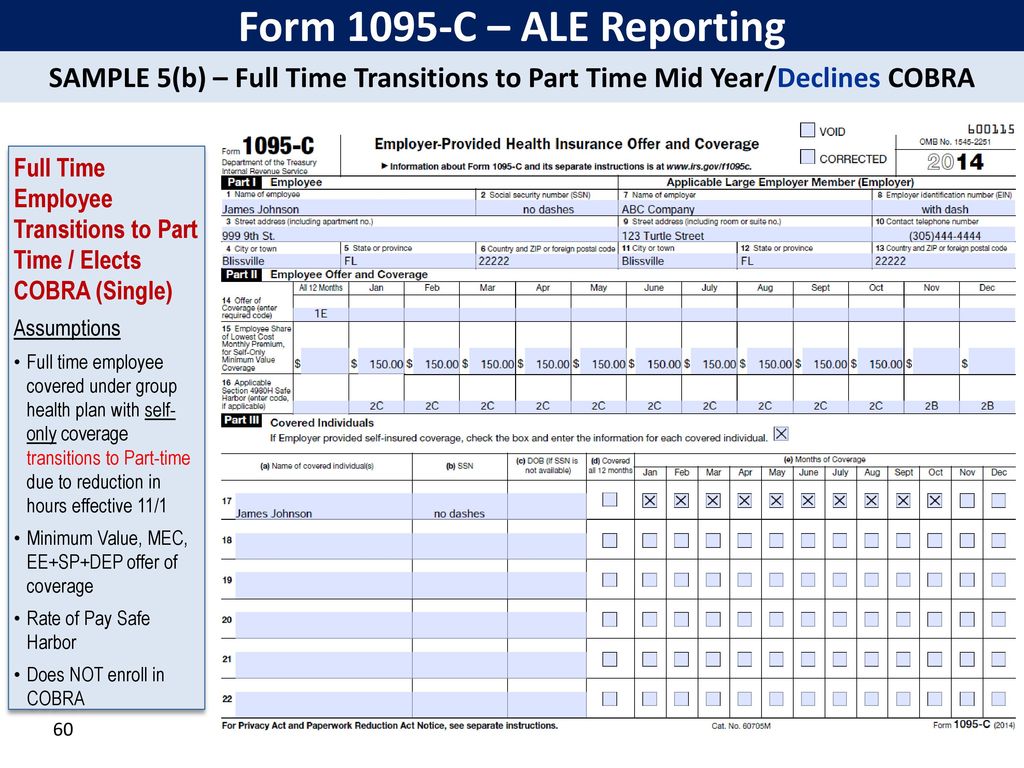

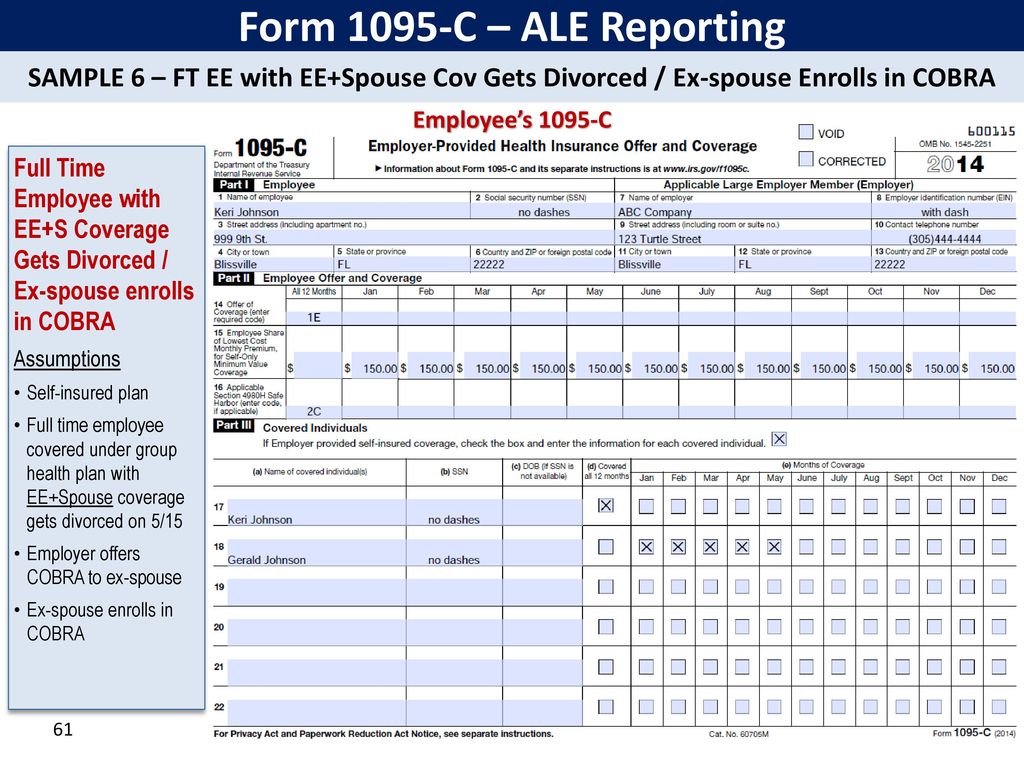

Completed 1095c example How to complete 1095 c Applicable Large Employers (for example, you left employment with one Applicable Large Employer and began a new position of employment with another Applicable Large Employer) In that situation, each Form 1095C would have information only about the health insurance coverage offered to you by the employerElectronic Consent W2 and 1095C 1 Log onto the Portal, mycuwedu, and select the 'Employee' tab 2 Locate the box labelled "Banner Self Service" 3 Click on the Employee Folder 4 Click on the Tax Forms Folder 5 Click on Electronic Regulatory Consent 6 Click on Either the W2 and/or 1095C box 7 Click Submit 8 Once submitted, you may exit the system Home Employee Self‐insured employers must report offers of COBRA coverage Employers complete Form 1095‐C providing COBRA coverage information (enrollment in COBRA coverage) How the Form 1095‐C is completed will depend, in part, on whether the employee was covered as an active employee during 18

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Www Jibei Org Media 1413 Aca Alert Irs Form 1095 C Information For Phbp Contributing Employers Pdf

And in this case, the report contains vital details about each employee's health insurance for the year Together, these forms are used to determine whether you pass the employer shared responsibility clause You'll send 1094C and 1095C to the IRS, and you'll also give a personalized copy of the 1095C to every single person on your team 3 Which brings usSample 1095C Forms The documents below are meant to be examples of what you should expect to see for some of the most common employee situations Each employee situation is different, so you may have employees whose 1095C forms do not match any of the example below To verify that those forms are correct, use the Line 14 and Line 16 guides aboveSample 1095 C form for Year and later Sample 1095 C form for Year 15 to 19

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Hr Emory Edu Eu Includes Documents Sections Home W2 Instructions Pdf

Creating the 1095C spreadsheet to be imported Although you can create your own spreadsheet to import 1095C information for your clients' employees, we recommend that you use the 1095C template spreadsheet that we have made available for exportThe 1095C template spreadsheet exports from Accounting CS populated with basic employee information that is formatted to match the Sample 1095CForm 1095 C 2 3 On the Self Service page, select the Benefits option on the left side, second row 4 On the Benefits page, select 1095C Consent 5 Read the language below regarding consent to electronically receive the 1095C If you agree, select the checkbox in front of "I consent to electronically receive Form 1095C" and select Submit 3 6 Upon selecting Submit, you will be6月 02, 21 For example, if an employer intends to file a separate Form 1094C for each of its two divisions to transmit Forms 1095C for each division's fulltime employees, one of the Forms 1094C filed must be designated as the

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Www Pge Com Nots Rates Tariffs Assets Pdf Tariffbook Gas Forms 79 1095 Pdf

How to Fill Out forms 1094C, 1095C Employer Health Coverage How to Fill Out forms 1094C, 1095C Employer Health Coverage Watch laterStep 5 Print Tax Form 1094C Click the top menu "Current Company" then the sub menu "Form 1094C" to view 1094C screen Note ez1095 software can print both 1095C and 1094 C forms for IRS and recipients on white paper No preprinted form is needed IRS changed form format in Year The Form has 2 pagesForm 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn more

1095c Form Acaprime Com

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

How to get the 1095 c form0416 You'll send 1094C and 1095C to the IRS, and you'll also give a personalized copy of the 1095C to every single person on your team 3 Which brings us to the next point — there's a good reason for you to fill them out The entire reason these forms exist is to show the IRS that you're providing your team with meaningful health careRelease62 Review and update Form 1094C before mailing or efiling forms to IRS Note IRS changed form format in Year The Form has 2 pages Year 1519 form has only one page;Form 1095C includes information about the health plan coverage offered to you by your employer and will be reported to the Internal Revenue Service Part II, includes information about the offer of coverage and coverage, if any, your employer offered to you and your spouse and dependent(s),

What You Should Know About Social Security Number Verification

1

Sample Notice to Employee, as Prerequisite to Electronic Delivery of Form 1095C Some employers prefer to furnish Forms 1095C to their employees electronically The IRS permits edelivery of the Form 1095C as long as the recipient consents The consent may be electronic, as in an email, or it may be on paper If on paper, the recipient must confirm his or her consent A An employer that is eligible for the Qualifying Offer Method Transition Relief for any employee who receives a Qualifying Offer for all 12 months of the calendar year may, in lieu of furnishing the employee a copy of Form 1095C, furnish a statement as described in "Alternative Method of Furnishing to Employees Under the Qualifying Offer Method" section in the 1094 and 1095C A Sample 1095 C Form is a request to the IRS asking for payment of tax debts A Form 1095 is not a request for an exemption, but instead is a request to the IRS to pay the appropriate amount of tax owed to the Internal Revenue Service In this article, we will discuss what a Sample 1095 C Form and what it is used for

1

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

A sample form is available on the IRS website 2 What does the 1095C form include?Sample Print of IRS Forms 1095B and 1095C If your printer can print on both sides of a sheet of a paper (duplex printing), then you can print the 1095 form with its respective mailing addresses and instructions on the back of each form You then trifold and stuff in any #10 size, 2 window envelope and mailYou are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, Part

1095 C 15 Pdf

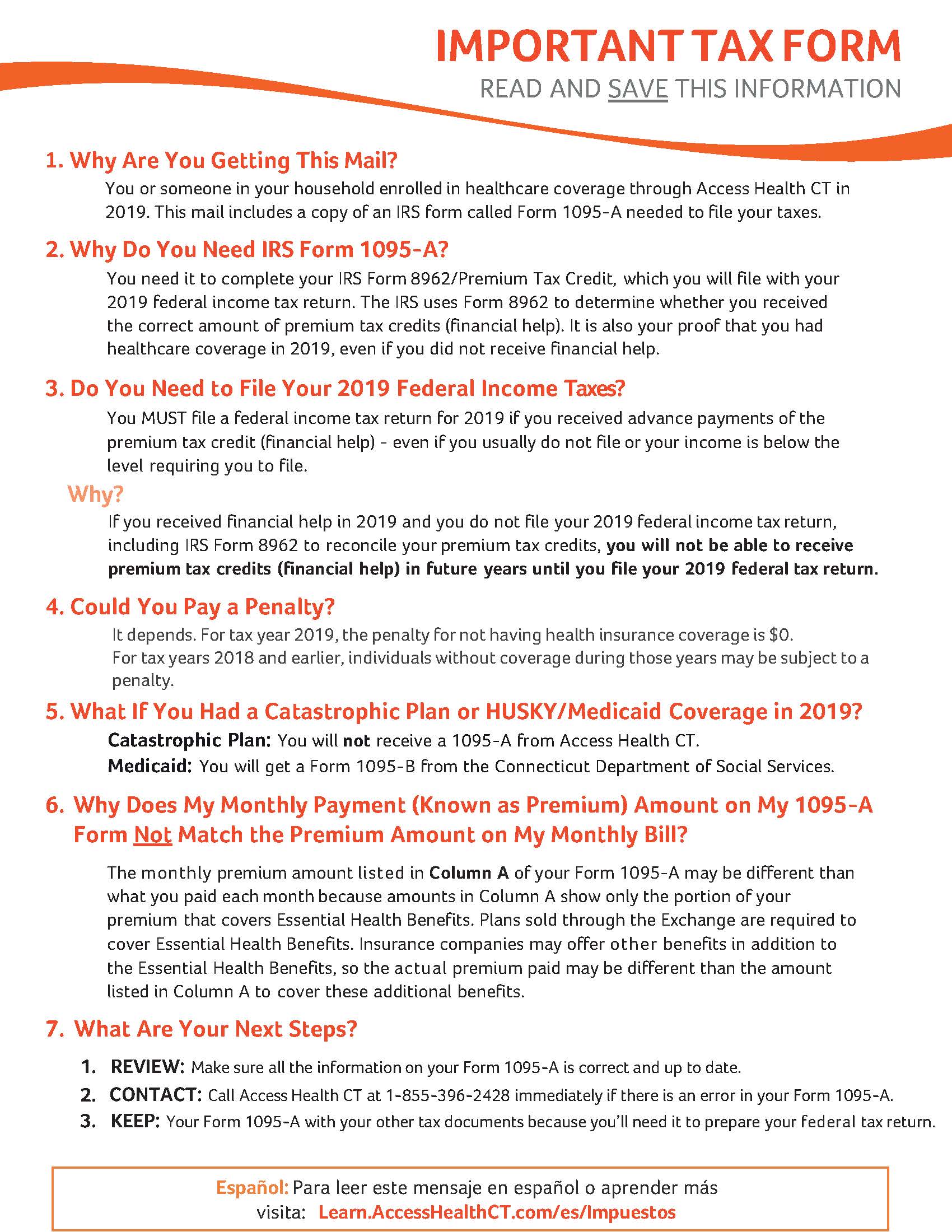

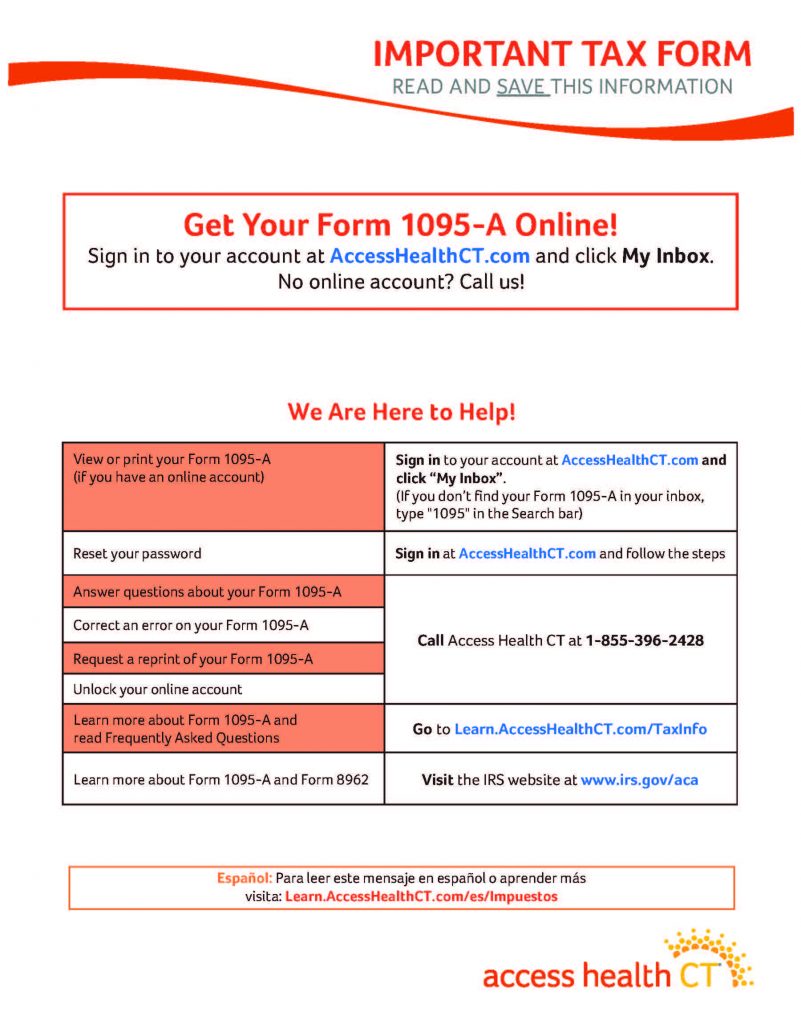

Tax Information Access Health Ct

Sample Excel Import File 1095C xlsx In Part 2, added field "Employee's Age on January 1" before the Plan Start Month field New codes for line 14 "Offer of Coverage" 1L, 1M, 1N, 1O, 1P, 1Q, 1R, 1S New field, line 17 "Zip code"Reference Guide for Part II of Form 1095C Lines 14, 15, and 16 (revised for the final 17 forms) November 17 • Lockton Companies L O CKT O N CO M P ANIES GLOSSARY Children means an employee's biological and adopted children (including children placed with the employee for adoption), from birth, adoption, or placement through the end of the month in which the child File Forms 1095C with the IRS for each fulltime employee, along with Form 1094C (the transmittal form) An IRS Q&A provides more information on 1095 filing requirements

Http Hbex Coveredca Com Toolkit Webinars Briefings Downloads 1095 A B C Quick Guide Final Pdf

Guide To Prepare Irs Aca Form 1095 B Form 1095 B Step By Step Instructions

SAMPLE Form1095C Department of the Treasury Internal Revenue Service EmployerProvided Health Insurance Offer and Coverage VOID CORRECTED Do not attach to your tax return Keep for your records Information about Form 1095C and its separate instructions is atwwwirsgov/form1095c OMB No Applicable Large Employer Member (Employer) When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14 and 16 of Form 1095CSample Form 1095C ACA 1094/1095 Reporting Requirements for 6 Guidance for Applicable Large Employers NOTE This guidance applies to Applicable Large Employers (ALEs) as defined in the ACA regulations and covers the ACA Shared Responsibility (aka, ACA "Pay or Play") Penalties This notice is not a substitute for reading and complying with the IRS Forms and

Http Www Healthreformbeyondthebasics Org Wp Content Uploads 16 03 Premium Tax Credit Tips And Tricks Pdf

Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Publication Attachments Dc health care info returns Pdf

Form 1095C An IRS form sent to anyone who was offered health insurance coverage through his or her employer The form includes information you may have to provide on your federal tax return1095 C Form Sample 1095 C Form 18 Form 1099 Best Of Instructions For Form 1099 Misc 17 Form 1500 Health Insurance Claim Form W2 Form Irsgov Where Do I Get A W9 Form Boc 3 Form Irs W 2 Form Box 12 Form 990 990 Ez Abf Bol Form 10 99 Form Hud 1 Form PdfForm 1095C is a new form designed by the IRS to collect information about ALEs and the group health coverage, if any, they offer to their fulltime employees Employers provide Form 1095C (employee statement) to employees and file copies, along with Form 1094C (transmittal form), to the IRS Form 1095C is comprised of three parts

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Www Cml Org Docs Default Source Uploadedfiles Issues Employment Health Care And Wellness Aca Pdf Sfvrsn 8fff1fe8 4

The TestScenarioId is only applicable to transmissions submitted to AATS and identifies which test scenario the Form 1095C represents CorrectedInd indicates if the record is an original (0) or a correction (1) to a record that the IRS has already received, processed, and acceptedWe recommend that you use the 1095C export feature to generate a template spreadsheet with basic employee information The format of this spreadsheet matches the industry standard for reporting 1095C information, so your clients' health care providers will be familiar with this format Once the employees' 1095C information has been added to the spreadsheet, you can import Form 1095C, EmployerProvided Health Insurance Offer and Coverage This form is furnished to those who had employersponsored coverage TIPmore about the reporting requirements here Employers can find out More on 1095B and C Forms Aside from reading the instructions, we suggest checking out the following PDF from UnitedHealth for more information on 1095B and 1095C forms

Www Shvs Org Wp Content Uploads 15 11 Illinois 1095 B Faq Pdf

2

Included on Form 1095C is information regarding Employers that fail to submit ACA Forms 1094C and 1095C annually could be subject to penalties under IRC 6721/6722 in Letter 5005A/Form 6A These penalties are separate from those assessed by the IRS for failing to comply with the responsibilities of the ACA's Employer Mandate form 1095a sample You can not receive all 3 forms As a customer, you do not need to produce this form because you are made by an insurance company Those interested in Obamacare prizes will end up being a huge problem for tax payers You may not have received the form because you have not found a subsidized health insurance, which is good news becauseWhat is Form 1095C?

Amazon Ehr Com Ess Client Documents Benefitsummaries 1095 C faqs updated 1 16 17 Pdf

Not Every Aspect Of Form 1095 C Can Be Outsourced

Form 1095C Department of the Treasury Internal Revenue Service EmployerProvided Health Insurance Offer and Coverage (for selfonly minimum essential coverage Information about Form 1095C and its separate instructions is at wwwirsgov/form1095c OMB No 15 share of the lowestcost monthly premium Part I Employee1095C – This form is used by fullyinsured and selfinsured ALEs to report information about the health plan coverage they offered to employees Selfinsured employers will fill out the formEach Form 1095C would have information only about the health insurance coverage offered to you by the employer identified on the form If your employer is not an Applicable Large Employer it is not required to furnish you a Form 1095C providing information about the health coverage it offered In addition, if you, or any other individual who is offered health coverage because of

Www Gadoe Org Technology Services Pcgenesis Documents Aca Test File Submission Pdf

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

1095c Departmant of Træsl_ry Internal RevenlÆ Service Part I Employee 1 Name of employ— Employee Smith 3 Stræt address apartment ro) 123 Maple Drive Unit 2 EmployerProvided Health Insurance Offer and Coverage Do not attach to your tax retum Keep for your records Information about Form 1095C and its separate instructions is at CORRECTED Gathering Information to Prepare Forms 1099NEC – TY Common 1095C Coverage Scenarios with Examples Completing 1095C forms can be confusing, but we're here to make it simple with this list of common 1095C coverage scenarios and examples

2

Aca Reporting Tip 19 Self Funded Plans Usi Insurance Services

2

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

How To Get Form 1095 A Health Insurance Marketplace Statement

Ultipro Enterprise Release Highlights 16 12 1 2 Fall

Tax Information Access Health Ct

Vehi Org Client Media Files 19 Small Sds Sus Reporting Information Guide 1094 95 B Forms Finalv3 Pdf

Www Whoi Edu Fileserver Do Id Pt 2 P 769

Http Www Fleming Kyschools Us Userfiles 4 My files Finance 1095c letter to employees Pdf Id

Ez1095 Software How To Print Form 1095 C And 1094 C

Irs Streamlined Installment Agreement Unique Form 1095 C Form C Ale Reporting Sample Full Time Transitions Irs Models Form Ideas

Otr Cfo Dc Gov Sites Default Files Dc Sites Otr Publication Attachments Dc health care info returns Pdf

Form 1095 A 1095 B 1095 C And Instructions

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Www Jibei Org Media 1413 Aca Alert Irs Form 1095 C Information For Phbp Contributing Employers Pdf

Form Irs 1095 B Fill Online Printable Fillable Blank Pdffiller

Www Cityofboston Gov Images Documents Aca information 16 Tcm3 Pdf

Benefitscape Com Portals 1 Xblog Uploads 16 10 27 Sample letter requesting extension for distributing forms 1095 Pdf

Www Ddouglas K12 Or Us Wp Content Uploads 17 11 From 1095 Faq 17 Pdf

Understanding Form 1095 C And What To Do About Errors The Aca Times

Aca Reporting And The Irs What To Know About The Letter You Received The Aca Times

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

Control Tables And Sample Forms

Www Brielleschool Org Cms Lib Nj0281 Centricity Domain 29 Affordable Care Act Employee Detailed Pdf

Consulting Americanfidelity Com Media 1439 18 01 17 17 Instruction Guide Step 3 Pdf

Irp Cdn Multiscreensite Com Fd05f735 Files Uploaded Aca user guide to the 1095 C form and associated codes Pdf

Publication 974 Premium Tax Credit Ptc Internal Revenue Service

Sample 1095 C Forms Aca Track Support

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

2

Form 1095 C Forms Human Resources Vanderbilt University

1095 C Printing Microsoft Dynamics Gp Forum Community Forum

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Www Dhcs Ca Gov Services Medi Cal Eligibility Documents Irs 1095 Form 1095b Reprint Covltr Eng Pdf

Www Pge Com Includes Docs Pdfs Tariffs Pdf

Instructions For Forms 1095 C Taxbandits Youtube

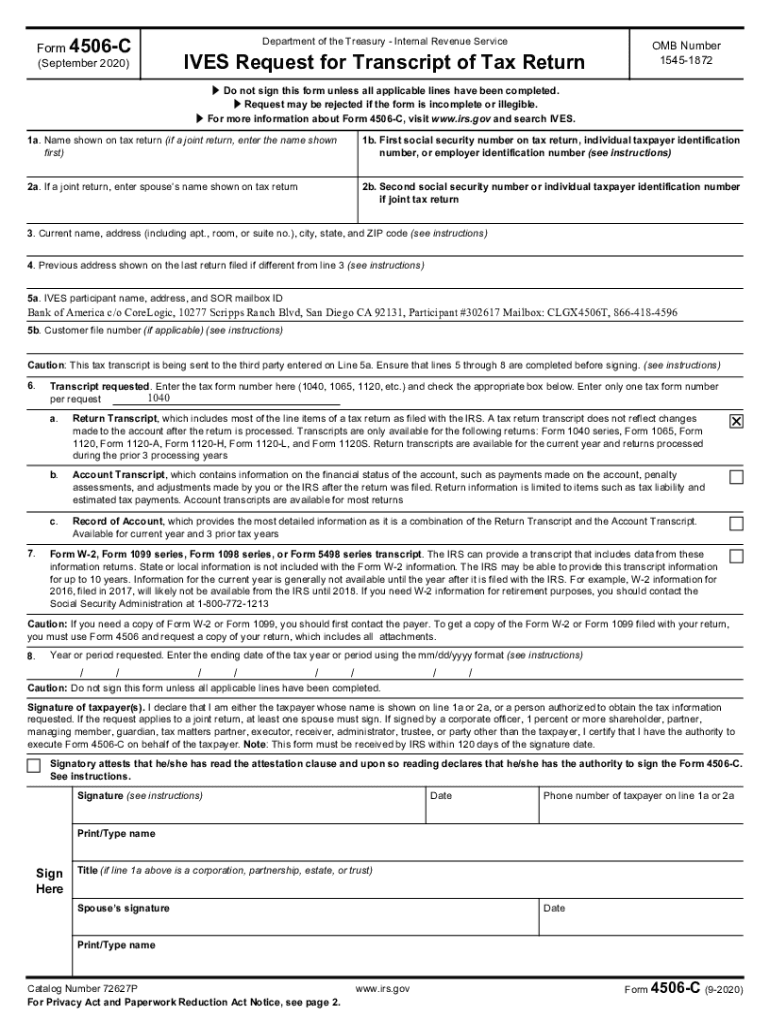

4506 C Fillable Form Fill And Sign Printable Template Online Us Legal Forms

Electronic Reporting Generate Documents In Pdf Format By Filling In Pdf Templates Release Notes Microsoft Docs

Www Ftb Ca Gov File Business Report Mec Info Ftb File Exchange System 1094 1095 Technical Specifications Part 1 Pdf

How To File 1099 S Online 1095 S Online With Efilemyforms

Aca Forms 1094 C And 1095 C And Reporting Instructions For The Aca Times

Http Www Healthreformbeyondthebasics Org Wp Content Uploads 16 03 Premium Tax Credit Tips And Tricks Pdf

Www Irs Gov Pub Irs Pdf F1095c Pdf

Dealing With Rejected Form 1095 C Returns

Guide For Viewing And Updating Payroll And Compensation Information Mass Gov

2

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 62 Premium Tax Credit Definition

2

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Understanding Your 1095 C Documents Aca Track Support

Form Irs 1095 A Fill Online Printable Fillable Blank Pdffiller

Www Irs Gov Pub Irs Prior Ib 19 Pdf

Www Cml Org Docs Default Source Uploadedfiles Issues Employment Health Care And Wellness Aca Pdf Sfvrsn 8fff1fe8 4

Www Cml Org Docs Default Source Uploadedfiles Issues Employment Health Care And Wellness Aca Pdf Sfvrsn 8fff1fe8 4

Aca Code Cheatsheet

Understanding Your Form 1095 A Youtube

2

Www Irs Gov Pub Irs Utl Aca App Trng Ppt Notes Pdf

Irs Delays Employers Deadline To Distribute Aca Reporting Form 1095 To Employees

Pro Ware Llc Aca 1095 Reporting

Tax Time Approaches Do You Know Where Your Forms Are Montgomery County Public Schools

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Electronic Reporting Generate Documents In Pdf Format By Filling In Pdf Templates Release Notes Microsoft Docs

Lawsons3 Dpsk12 Org Lawson Dps W2 electronic enrollment quick ref guide Pdf

Tax Forms Payroll Office Grand Valley State University

2

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

1095 C Form 18 Lovely Amazon Flex 1099 Forms Schedule C Se And How To File Taxes Form Q Models Form Ideas

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Irs Form 1098 C Software Efile For 2 449 Outsource 1098 C Software

390 Best W2 Forms Ideas In 21 W2 Forms Form Tax Forms

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement Templateroller

Aca Reporting And The Irs What To Know About The Letter You Received The Aca Times

0 件のコメント:

コメントを投稿